Overview

Boulder County is part of the seven-county Denver Metropolitan Area. Boulder County is an ecologically diverse county with arid plains, foothills and mountainous terrain, providing good access to the state’s many natural recreational amenities for local residents and tourists. The area’s early settlement and development utilized the plains setting for agriculture and ranching as well as the mountains for mining and prospecting. The major cities in Boulder County are Boulder (county seat), Superior, Louisville, Lafayette Longmont and Erie (the last two partly in Weld County). Boulder is home to the University of Colorado founded in 1876 as Colorado’s first university and is a large influence on the county’s economy. Boulder County’s economy include such industries as aerospace, bioscience, data storage, natural and organic products, outdoor recreation, renewable energy, software and tourism.

Transportation

Boulder County is approximately 25 miles from Denver. The major transportation route into Boulder County from Denver is Highway 36 also known as the Boulder Turnpike. The Boulder Turnpike was originally a toll road from its opening in 1952 until 1967. Highway 36 continues north through the City of Boulder to Lyons. Another major thoroughfare following the foothills from Golden to Boulder is Highway 93. There have been suggestions to expand E470 into Boulder County to Jefferson County, completing the Metropolitan Denver 470 Interstate loop, but concerns have been raised from citizens in Boulder County and Jefferson County about traffic and funding. State highway 287 runs north/south and connects Highway 36 in Broomfield (Broomfield County) with Lafayette and Longmont in the northeast portion of Boulder County. The primary east/west routes within Boulder County are Highway 7, Highway 52 and Highway 66. The Diagonal Highway (Highway 119) is the main thoroughfare between north Boulder, Gunbarrel and Longmont.

Economic Indicators

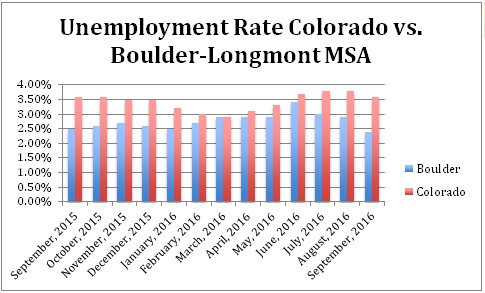

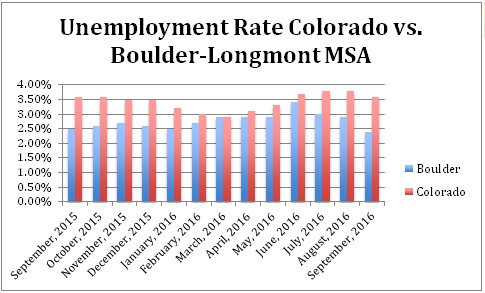

The following is from the September 2016 (the most recent available) Economic Indicators Report published by the Boulder Economic Council, and the October 2016 labor market indicators from the Colorado Department of Labor. For statistical purposes, Colorado Department of Labor reports relied upon the Boulder-Longmont Metropolitan Statistical Area (MSA) for reporting.

Employment

Boulder County’s unemployment rate in October 2016 was recorded as 2.4 percent. The unemployment rate in Boulder is down 0.5 percent over the prior month, and at its lowest level since December of 2000. There are currently 8,669 jobs available in the Boulder-Longmont MSA job market, and unemployment in the Boulder market is consistently below Colorado’s overall unemployment rate.

The largest employment sectors in the Boulder-Longmont MSA include Government (Federal, State and Local) of 20.29 percent, Professional and Business Services of 18.01 percent, and Educational and Health Services of 13.0 percent.

Below are the top 10 industries by projected growth for the Boulder-Longmont MSA for the 2015 – 2025 time period

Total Boulder employment increased by 1.67 percent month-over-month in September 2016. Total employment in Boulder expanded by 4,784 jobs, or 2.76 percent, year-over-year in September 2016.

Business Confidence

The Leeds Business Confidence Index, based on Colorado business leaders’ expectations, dropped slightly from 55.4 in the second quarter of 2016 to 54.6 anticipated for the third quarter of 2016, still indicating positive expectations. The Leeds Business Confidence Index has been above 50 since 1 Q 2012.

Venture Capital Investment

In 1 Q and 2 Q 2016, Boulder companies received $29.5 million in venture capital investment, representing approximately 24 percent of all investment in Colorado. Since 1 Q 2014, Boulder companies have received $504 million in venture capital investment, representing approximately 30 percent of all Colorado venture capital investments.

Residential Real Estate

The number of single-family homes sold year-to-date in Boulder was down 11.6 percent over the same period in 2015; however, the median single-family home price was up 14.67 percent over the same time last year, and 31 percent since 2014.

In the residential rental market, apartment vacancies were 5.9 percent for Boulder and Broomfield Counties in 2 Q 2016, compared to 6.6 percent in the previous quarter.

Commercial Real Estate

Commercial vacancy rates have been in the single digits in Boulder Colorado since 1 Q 2013. Office vacancies have increased slightly from 4.3 percent vacancy in 2 Q 2015 to 6.4 percent in 2 Q 2016. In the same time, industrial vacancy has gone from 2.6 percent to 3.9 percent. These increases are partially due to new inventory on the market. Retail vacancies have lowered 218 percent to 1.7 percent in 2 Q 2016.

Gross Domestic Product

According to the Bureau of Economic Analysis, the nominal gross domestic product (GDP) for Boulder County was an estimated $23.4 billion in 2015. GDP grew 5.3 percent between 2014 and 2015.

Boulder Colorado MSA GDP by year (2001 – 2015)

Retail Sales Tax Collection – City of Boulder

Retail sales, reflected by the city sales tax collections, have continued to increase after slipping in 2008 and 2009. Much of the increase in retail sales in 2007 can be attributed to the opening of the Twenty Ninth Street Shopping District in late 2006.

Tourism

Boulder is a popular destination for local and out of state visitors, and tourism is a significant contributor to the Boulder economy. Despite its location at the foot of the mountains, Boulder has an urban feel and offers an impressive variety of art, cultural, and entertainment choices that set it apart from most cities its size. Boulder has more than 30 art galleries and has been recognized as one of the nation’s top cities for art. Boulder is home to five local museums, 32 movie and stage theaters, a resident symphony, and offers a notable number and variety of cultural events. The city’s dining and craft brewing scenes have exploded and Boulder is now a nationally recognized dining destination. Boulder’s commitment to supporting small, unique merchants as well as national retailers has helped create an appealing array of shopping choices.

Tourism in Boulder is supported by the presence of the University of Colorado as well as the city’s surroundings and amenities. The area offers scenic beauty, great weather, and abundant recreational opportunities. Boulder is surrounded by over 45,000 acres of open space and has over 150 miles of public hiking and biking trails including the Boulder Creek Path, a trail featuring pedestrian and bicycle lanes that runs through the middle of town. Boulder Canyon is only a 10‐minute drive from downtown Boulder; Eldora Mountain Resort, Eldorado Canyon State Park, and Rocky Mountain National Park are less than an hour away. Each year, the city hosts one of the nation’s largest 10k races, the Bolder Boulder. In 2015 Boulder hosted one leg of the IRONMAN circuit and a Republican debate which took place in the University of Colorado’s Coors event center.

Hotel occupancy rates, average daily room rates, and average revenue per available room, as well as sales tax receipts for select categories and shopping areas provide further insight into the city’s tourism activity. Average hotel occupancy rates in the city have been improving and remain consistently higher than state and national averages for cities with similar characteristics. Average daily rates in the city are lower than the Colorado ski average and higher than the national average for cities with similar characteristics to Boulder.

Demographics

The following are 2016 and 2021 estimates for Boulder County and were provided by the CCIM/STDB (from December 2016, the most recent available):

Population

In the identified area, the current year population is 316,987. In 2010, the Census count in the area was 294,567. The rate of change since 2010 was 1.18 percent annually. The five-year projection for the population in the area is 338,316 representing a change of 1.31 percent annually from 2016 to 2021. Currently, the population is 50.2 percent male and 49.8 percent female.

Households

The household count in this area has changed from 119,300 in 2010 to 127,213 in the current year, a change of 1.03 percent annually. The five- year projection of households is 135,615, a change of 1.29 percent annually from the current year total. Average household size is currently 2.41, compared to 2.39 in the year 2010. The number of families in the current year is 73,270 in the specified area.

Housing

Currently, 56.4 percent of the 135,006 housing units in the area are owner occupied; 37.9 percent renter occupied; and 5.8 percent are vacant. Currently, in the U.S., 55.4 percent of the housing units in the area are owner occupied; 32.9 percent are renter occupied; and 11.7 percent are vacant. In 2010, there were 127,071 housing units in the area – 59.0 percent owner occupied, 34.9 percent renter occupied, and 6.1 percent vacant. The annual rate of change in housing units since 2010 is 2.73 percent. Median home value in the area is $423,986, compared to a median home value of $198,891 for the U.S. In five years, median value is projected to change by 1.25 percent annually to $451,082.

Income

Current median household income is $69,924 in the area, compared to $54,149 for all U.S. households. Median household income is projected to be $80,516 in five years, compared to $59,476 for all U.S. households. Current average household income is $99,491 in this area, compared to $77,008 for all U.S. households. Average household income is projected to be $109,042 in five years, compared to $84,021 for all U.S. households. Current per capita income is $40,436 in the area, compared to the U.S. per capita income of $29,472. The per capita income is projected to be $44,186 in five years, compared to $32,025 for all U.S. household.

Conclusion

Boulder County’s economy is strong, and continues to outpace Colorado overall in terms of unemployment. The strength of Boulder’s economy is further evidenced by a high percentage of venture capital investment relative to the state of Colorado overall, and continued GDP growth year over year. Housing continues to be strong, with low rental vacancy rates, and a 31 percent increase in the price of single-family housing since 2014. Boulder’s economic strength is also reflected through commercial real estate with office, industrial and retail vacancies all below 4.5 percent.

Given almost all economic indicators researched appear to be strong, it is anticipated that economic strength will continue into the near future.

Recent Comments